Retailers-Must-Know: Understanding Market Manipulation in Cryptocurrency

Outlines the complex process of market manipulation, particularly in the context of cryptocurrency markets

In the vast and volatile ocean of the cryptocurrency market, understanding the waves created by the so-called "whales" is crucial for every investor. Contrary to the popular belief in the randomness of market movements and the wisdom of the crowd, a closer examination reveals a more orchestrated reality. Market manipulation, a term often whispered in the dim corners of financial discussions, emerges starkly in the light of day when we scrutinize the mechanics of cryptocurrency trading.

The Illusion of the Invisible Hand

The notion that market prices are solely guided by an invisible hand, reflecting the collective decision-making of investors, is a myth. Instead, these prices are often the result of deliberate manipulation by powerful entities within the market. Governments, regulators, and, more pertinently, insiders with significant financial clout—referred to as "whales"—have the capability to sway the market in directions favorable to them. Manipulation is not an anomaly; it is pervasive across all financial markets, including stocks, bonds, commodities, and cryptocurrencies.

Whale Watching: Tracking the Titans

Whale watching is not just an activity for marine biologists but also a strategy for traders who aim to predict market movements by monitoring the actions of these influential investors. Whales, by virtue of their substantial resources, can significantly impact market dynamics with their trading decisions. The strategy for the astute investor is not to outmaneuver these whales but to understand their movements and, if possible, swim in their wake.

The Anatomy of a Pump and Dump

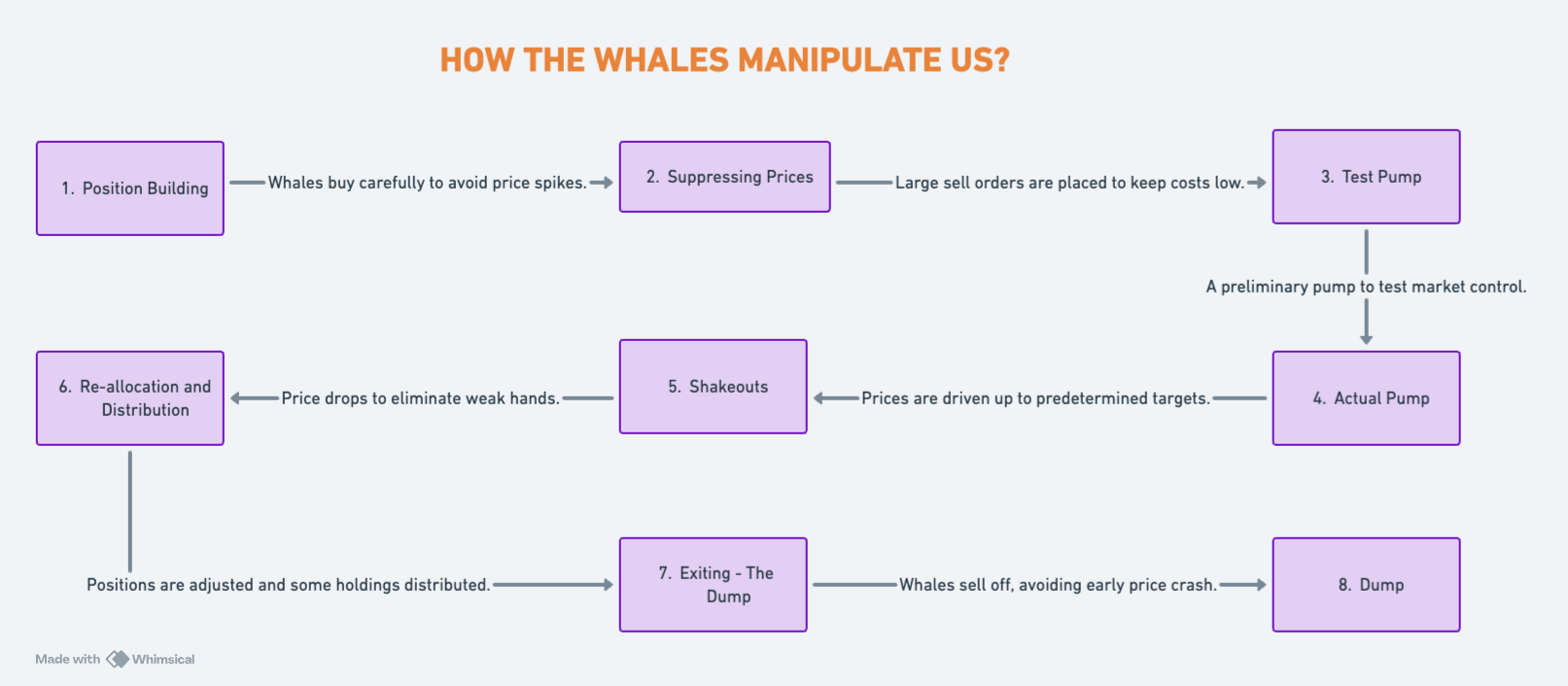

A pump and dump scheme, often perceived as a straightforward manipulation tactic, involves several intricate stages:

1. Position Building: Whales accumulate a significant position in the market through careful buying, avoiding price spikes.

2. Suppressing Prices: To keep acquisition costs low, whales may intentionally suppress prices with large sell orders.

3. Test Pump: A preliminary pump to test market control and identify weak hands.

4. Actual Pump: The main event, where prices are driven up to previously determined targets.

5. Shakeouts: Aggressive price drops to eliminate weak hands and consolidate control.

6. Re-allocation and Distribution: Adjusting positions and possibly distributing some holdings to manage risk.

7. Exiting - The Dump: Whales sell their positions, often using sophisticated strategies to avoid crashing the price too early.

Strategies for Retail Investors

In the treacherous waters of cryptocurrency markets, where whales often dictate the current, retail investors must sail with caution and strategy. Understanding the mechanics behind market manipulation provides a foundational insight, but actionable strategies are necessary for survival and success. Here are key approaches retail investors can adopt to navigate and potentially thrive in these manipulated markets:

1. Education and Awareness

Knowledge is Power: Educate yourself on the basics of the cryptocurrency market, including how trading works, what affects market movements, and the signs of potential manipulation. Understanding volume, price patterns, and the impact of large trades can provide early warning signs of manipulation.

2. Critical Analysis of Market Sentiment

Look Beyond the Hype: Market sentiment, often influenced by social media, news, and influential personalities, can lead to irrational trading decisions. Learn to critically analyze news and trends, distinguishing between genuine growth potential and manipulation-driven hype.

3. Long-term Investment Over Speculation

Invest, Don’t Gamble: Focus on long-term investments in cryptocurrencies with solid fundamentals, clear use cases, and strong development teams. This approach minimizes exposure to volatile market swings driven by manipulation.

4. Diversification

Spread Your Risks: Diversify your investment portfolio across different cryptocurrencies, sectors, and asset classes. This strategy helps mitigate losses if one investment falls victim to manipulation or adverse market movements.

5. Use of Stop-Loss Orders

Limit Your Losses: Utilize stop-loss orders to automatically sell your holdings if the price drops to a certain level, protecting you from significant losses during sudden market downturns often seen after manipulative pump-and-dump schemes.

6. Emotional Discipline

Stay Calm and Collected: The cryptocurrency market can test your emotions with its highs and lows. Maintain discipline, avoiding panic selling during dips or FOMO (fear of missing out) buying during surges.

7. Community Engagement

Learn from Others: Engage with reputable cryptocurrency communities and forums. These platforms can offer support, insights, and warnings about potential manipulation or other risks.

8. Critical Reflection

Know When to Step Back: Sometimes, the best strategy is not to play the game set by manipulators. Reflect critically on your investments and strategies, and be prepared to step back if the risks outweigh the potential rewards.

Winning the Game

Winning in a market influenced by manipulators doesn't necessarily mean outperforming them or predicting their next move. Instead, it involves safeguarding your investments through informed decisions, diversified strategies, and emotional control. Remember, in the volatile world of cryptocurrencies, sometimes the greatest victories come from the losses you avoid.

Conclusion

The world of cryptocurrency trading is fraught with the machinations of those who control significant market power. The story of Dogecoin's manipulation below is not just a tale of financial maneuvering but a lesson in the importance of vigilance and understanding. As investors, recognizing the signs of manipulation and the strategies of whales can be the difference between swimming with the current or being left adrift. It's a stark reminder that in the game of deception, knowledge is your only lifeboat.